On 9 November, in Palermo, there was the first edition of the ExportItalia prize, an award for the most successful companies in the international arena, organised by Uniexportmanager under the patronage of the Ministry of Foreign Affairs and Cooperation. It was won by the Sardinian company of Mariantonia Urrua textile company from Samugheo, in the province of Oristano, specialising in the supply of textile furnishings for the hotel sector and in high-design carpets.

Mariantonia Urru's is the classic Italian family-run micro enterprise, with few employees and a modest turnover. On paper, the archetype of a company with little international potential: small, with artisanal and rather slow production processes (it takes about fifteen days to make a five-square-metre carpet) and in an economically disadvantaged area. Yet, the specificity of its product and the excellence of its production process have made it an internationally successful business, leading it to export to some fifteen markets worldwide.

The know-how to export

Mariantonia Urru's story is actually the story of many Italian companies that, despite their small size, have every potential to conquer foreign markets. The only reason why they do not is that, often, the activities required before they can start exporting need a level of know-how of internationalisation processes and foreign markets far greater than is available. In addition, the logistical structure required for the export of goods and services often needs considerable investment.

These facts generate a Darwinian natural selection mechanism: only the largest, most productive or financially strongest companies manage to overcome these 'entry barriers' to foreign markets and become exporters. This is where export support programmes such as the Project SEI (Italian Export Support), by the Chambers of Commerce, or private consultancy systems offered by banks and financial operators, with the aim of assisting the company and enabling it to overcome these barriers.

Identifying high-potential enterprises

But how do we identify companies like Mariantonia Urru, which possess the right characteristics to export successfully? The question is complex and depends on a combination of sectoral, financial and production factors. There is a need for a tool that is able to assess them simultaneously, declining them specifically in the different product segments and geographical and industrial fabric of reference. In other words, it is a matter of condensing an enormous amount of information on the company and its specifications, obtaining an informative measure of its internationalisation potential. For such a task, there is nothing more suitable than modern machine learningcapable of analysing huge volumes of data and identifying trends and patterns that characterise a phenomenon.

The machine learning to solve complex problems

A group of researchers from IMT School used precisely this approach, described in the study "Predicting Exporters with Machine Learning", applying it to the French manufacturing sector. The research used a dataset of companies in this sector and with machine learning constructed an index measuring whether a company has the potential to become a successful exporter and how far it is from this goal. In their study, the researchers used a battery of fifty-seven different variables: some were balance sheet data, productivity indices and geographical and sectoral information, others were measures of the incidence of the number of exporters in the segments to which the company belongs.

To analyse this mass of data, they used the BART-MIA (Bayesian Additive Regression Tree with Missingness In Attributes), an algorithm of machine learning Bayesian, based on decision trees. The advantage of this algorithm is that it allows different variables to play a different role depending on the specific context in which the company operates: the size and production characteristics of Mariantonia Urru, for example, would classify it as an unsuitable company for exporting, if compared to the textile companies in the industrial district of Prato. But in the context of Sardinian craft manufacturing, these characteristics are sufficient. This is the kind of specific contextualisation that a decision tree model is able to distinguish and exploit in order to measure the internationalisation potential of a company.

An exporters' score

In the IMT School's research project, the BART-MIA algorithm was able to distinguish exporting from non-exporting companies with an accuracy of ninety per cent. Based on the results obtained, a score was then generated, called "exporting score", which measures how far a company is from possessing the characteristics of a successful exporter. This score should be interpreted as a measure of the risk associated with the investment of capital and resources in its internationalisation project. It follows that the higher the score is, further away the company is from possessing the characteristics of a successful exporter and the greater, therefore, the risk if one decides to invest in it. Using theexporting score It was also possible to identify - in the context of French manufacturing - pockets of potential exporters, i.e. areas and sectors in which there are companies that are not exporting, but which would have all the credentials to do so.

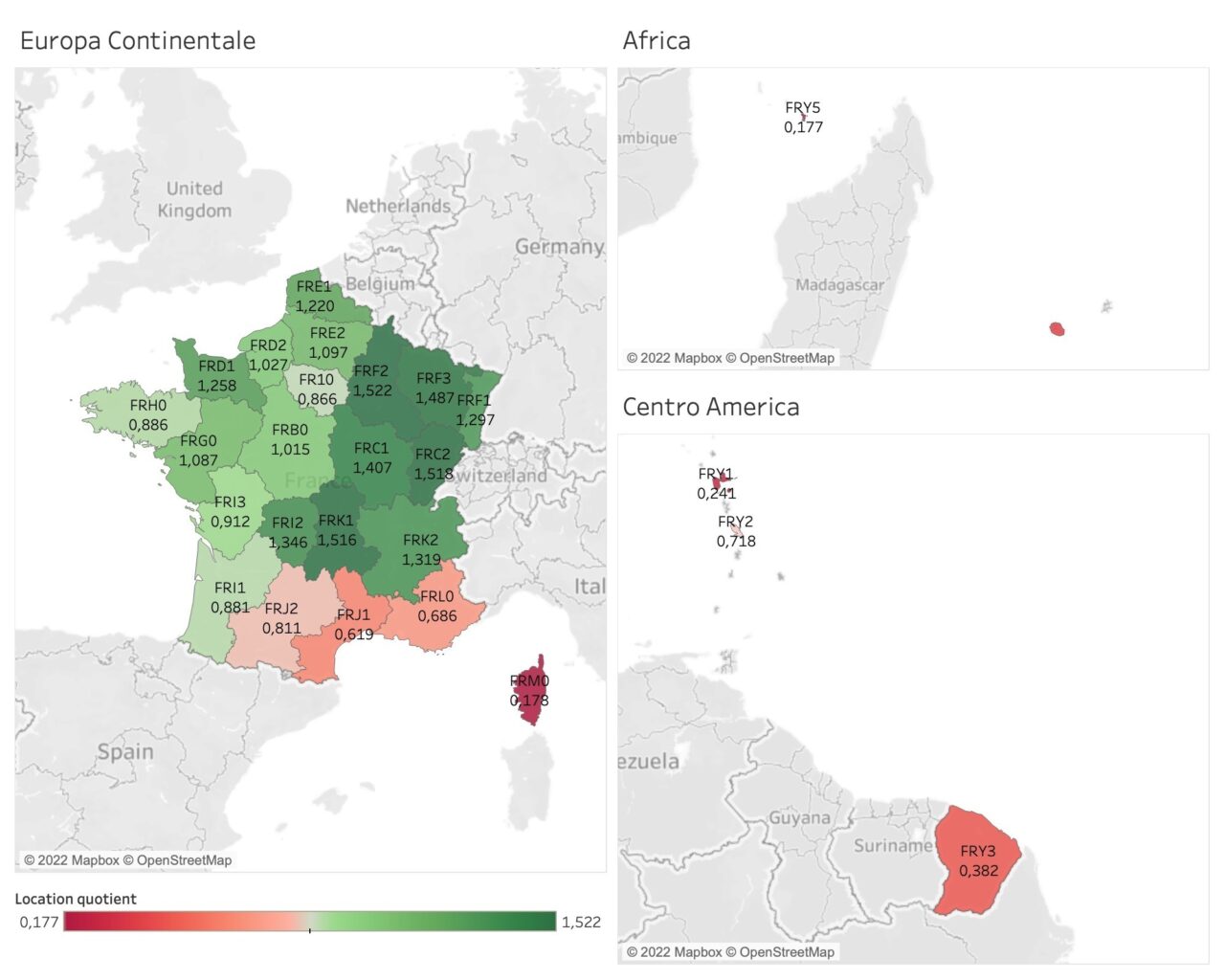

Plotted on a map, these data can provide some interesting indications: some regions of France traditionally not considered to have high productivity have been identified as having high potential. Ile-de-France, for example, is considered the most productive region in the country, on par with our Lombardy region. One might therefore expect it to be a region with a high concentration of potential exporters. On the contrary, the study shows that there are other regions with more potential that deserve to be studied more closely by French export support policies. In the map shown, we can observe that the areas with a high concentration of potential exporters are clustered in North-Eastern France. In contrast, the regions of southern France and the non-European territories are less interesting for trade policies.

Potential of the score and possible applications

L'exporting score devised by IMT researchers is a first attempt to exploit the new information potential generated by the world of Big Data in the context of the international economy. Moreover, if it becomes a tool available to the policy makers, could help them to plan economic policies more carefully, investing in the right targets and minimising the waste of resources.

The idea is that, on one hand, export support institutions - such as Chambers of Commerce and banks - can use the exporting score to have a first measure of how risky it is to invest in a company that requires them to finance; on the other hand, that authorities and regions can identify potential exporters and their characteristics within their own catchment area. The algorithm itself produces detailed statistics at sectoral and regional level on what are the salient aspects that define a good exporter in different contexts. This would allow the policy maker to produce specific intervention measures depending on the barriers identified by the algorithm.