Rising energy bill prices, difficulties in finding everyday products, and rising purchase prices are just some of the effects that we are all experiencing, as consumers or producers, as a result of the shocks that the international economy has suffered in recent months. The outbreak of the Covid-19 pandemic not only caused a global health crisis, but also dramatically affected international trade as a result of the severe restrictions on the movement of people and goods imposed by governments: domestic companies in many sectors came to a standstill when faced with the inability to source the raw materials needed for production and the lack of liquidity needed to manage cash flows. Similarly, today, while companies are restarting, albeit at different rates, in the post-Covid world, Russia's invasion of Ukraine has triggered one of the worst energy crises in decades, with repercussions not only on Europe but on many other countries that are suffering or benefiting from the strong fluctuations in the gas and electricity markets. So, while an Italian family is paying bills that have doubled compared to the previous year and small entrepreneurs are struggling to keep their businesses open, International Monetary Fund estimates predict that economic recovery from the pandemic crisis will be severely slowed because of the ongoing conflict, and Italy will suffer the effects by entering recession from the third quarter of 2022.

Why is all this happening?

The global economy in recent history has been characterised by increasing integration between countries, fostered by the numerous trade agreements concluded to break down tariff and non-tariff barriers, and by rapid technological advancement, especially for digital tools. Taking a step back, recent decades have witnessed a phase of strong acceleration of globalisation, first with the post-war economic boom and then, from the 1980s onwards, with the growth of the large emerging economies, most notably China and India, and with the fall of the Soviet bloc in Eastern Europe, which triggered a period of economic liberalisation. As a result, economies that were previously limited to importing and exporting finished products and centred on a domestic production model, became global and interconnected, resulting in the creation of production chains that transcend national borders and are characterised by a strong fragmentation of the various production stages. Thus today, to produce a car or a smartphone, companies located all over the world are involved, each of which carries out a specific stage of the production process, and then exports its semi-finished products to the next company in the supply chain. In this way, interconnected production chains are created, giving rise to genuine production networks in which companies carry out their activities in a context of mutual dependence. This inevitably means that every company involved in a global production process is vulnerable and exposed to the shocks that other companies in other parts of the world or in other sectors may experience. Thus, the globalisation phenomenon reached a peak in 2008, only to come to an abrupt halt following the financial crisis that originated in the United States and affected Europe and the rest of the world.

Deglobalisation and slowbalisation

Since then, many economists have started talking about de-globalisation to connote a new phase that the world economy is going through, characterised by a return to a more domestic dimension of economies and a progressive regionalization of production chains. But can there really be a return from this situation? What is certain is that the last ten years have witnessed a marked slowdown in international trade and a change in the geopolitical scenario: China, led by President Xi Jinping, has initiated a series of policies aimed at promoting the development of technologically advanced domestic industries in an attempt to become a leader in the production of high value-added products. Meanwhile, in 2018 in the United States, Donald Trump, under the slogan of 'America First', in an attempt to counter the Asian threat has promoted a series of protectionist policies by initiating a trade war to target strategic sectors in which China plays a central role, but with negative effects affecting Europe and America itself. However, although there are many signs that might point to a reversal of this trend with a return to a national dimension of the economy and the end of globalisation, it seems more realistic to consider the changes underway as the fruit of a period of hyper-globalization that has been sustained by several factors, including the technological and digital revolution and the strong acceleration in the liberalization of trade and capital flows. From this perspective, the era we are living through today is not one of de-globalization, but rather slowbalization.

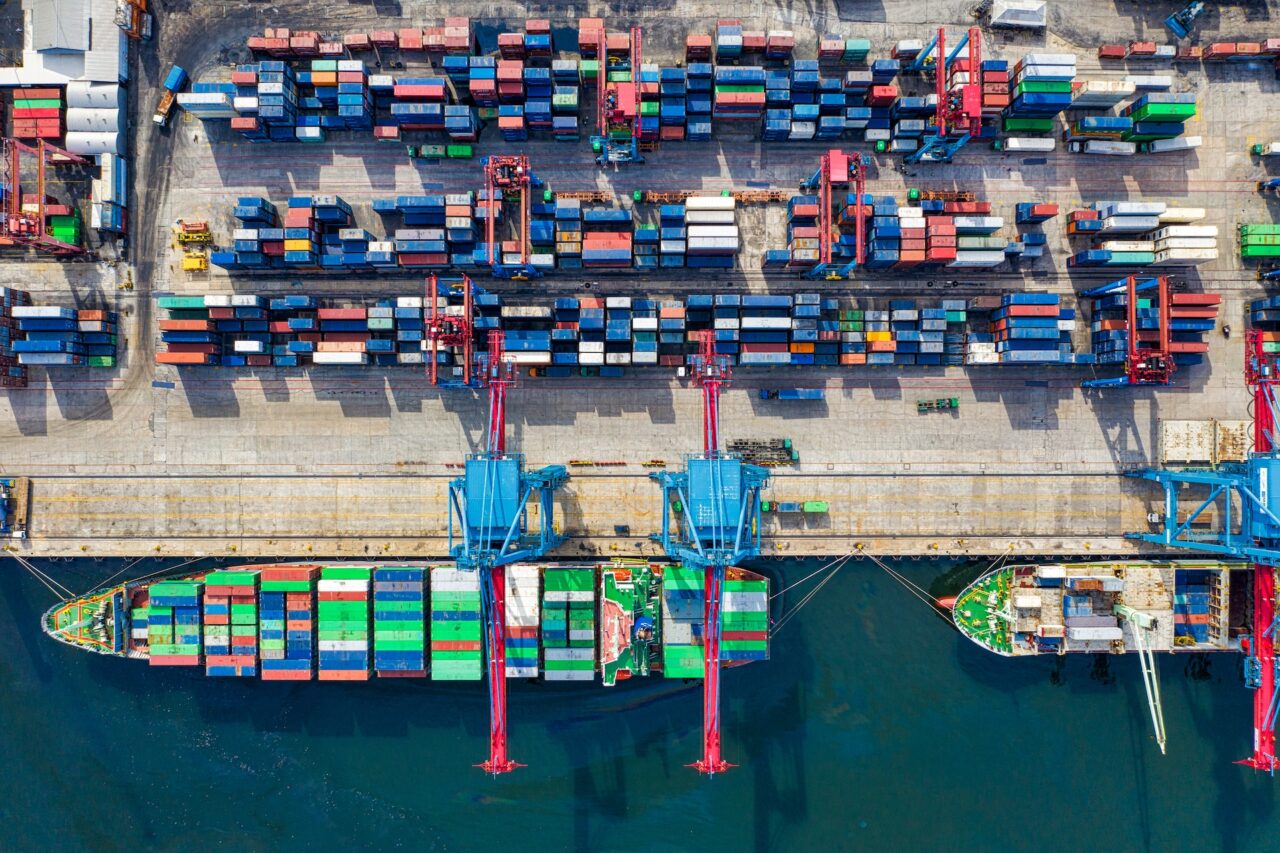

Fragile supply chains

The new economic shocks that states have experienced in the last three years have highlighted the fragilities inherent in global production chains, making companies more aware of the need to reconfigure their production networks. While the primary objective of multinationals has so far been to locate parts of production in countries where cost advantages exist in order to maximise profits and improve productivity, the Covid-19 pandemic and the outbreak of the conflict between Russia and Ukraine have made clear the importance of creating production networks that are potentially less efficient but more secure, flexible and resilient. A scenario in which companies give up global production chains and massively revert to domestic production - so-called reshoring - seems unlikely when one considers the large investments and fixed costs that a company bears to set up a production facility abroad. Persistent shocks on the demand or supply side would be needed to induce companies to radically change their production processes. Instead, the pandemic can be seen as a shock of a temporary nature, leading to the bankruptcy of smaller, less productive companies with difficulties in accessing credit, but overcome by the rest of the companies, often with a strong recovery during 2021. For such companies, it is crucial to implement new business strategies to insure themselves against future shocks.

New strategies to withstand shocks

Some large multinationals are already experimenting with new ways of managing their production processes in order to better respond to shocks: Amazon and the large shipping company Maersk are moving to an air transport model in order to compensate for potential bottlenecks in sea supplies that have occurred recently, especially in Asian ports. General Electric's healthcare division is investing to diversify its supplier network and is expanding its facilities as a result of the acute shortage in the supply of semiconductors in the medical technology sector. In the automotive sector, companies such as Toyota, Tesla and Volkswagen are changing the classic just-in-time production process to increase inventories of batteries, chips and other key components to ensure upcoming car deliveries. In order to remain competitive, the other companies in the market will also have to follow the steps taken by the leaders and readjust their production processes accordingly. The trend, therefore, seems to indicate that, if companies know how to adapt and respond proactively to the critical issues that the current crises have brought to light, we should not expect a de-globalized world and isolated economies to return in the future, but rather a global economic system in which production chains will be less dependent on a few key suppliers concentrated in particular countries, more diversified, decentralized and therefore capable of coping with the risks associated with the growing framework of uncertainty that the world economy will face in the years to come.